Spain: Still in the Throes of the Great Recession

The Spanish Economy Sinks Further

On this page we present the salient features of the Spanish Economy since the onset of the Great Recession in historical perspective, where the comparison is with the prior business cycles that we identify in Spain given available data. We able to identify three cycles.

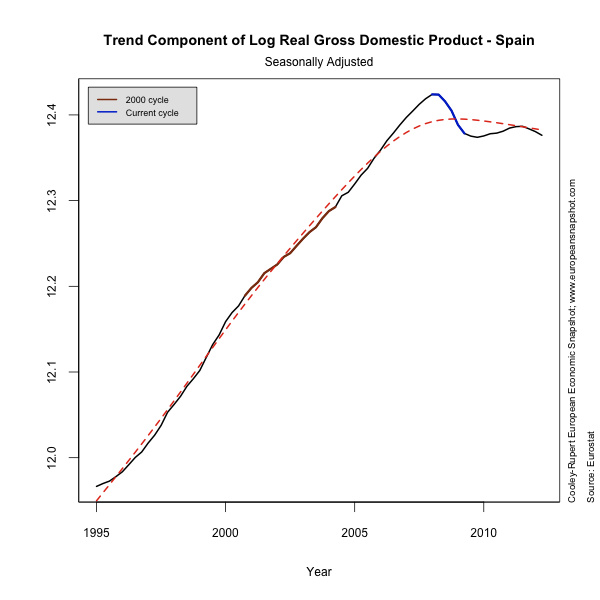

The first figure below shows the path of Real GDP in Spain and the estimated trend component (see the page on Identifying European Business Cycles) which is the basis for our analysis.

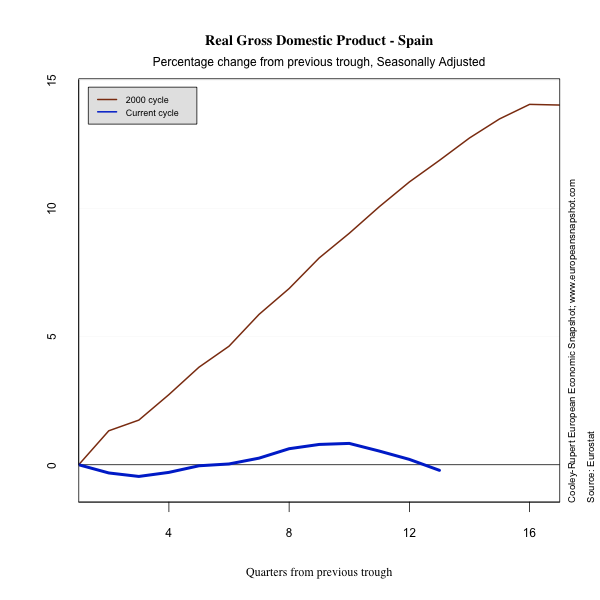

We are only able to identify two cycles in the available data for Spain and the cycle in early 2000 was extremely mild. We are working to obtain more extensive data. The following figure plots the percentage change in Real GDP for these two cycles.

Looking at the recoveries from the trough shows much the same message.

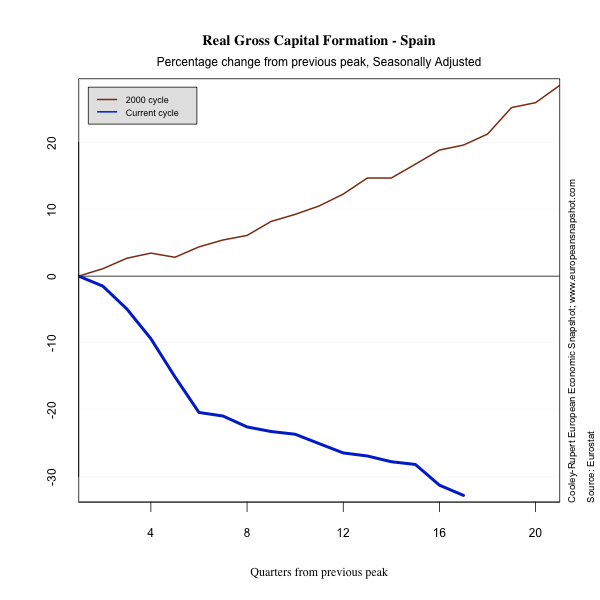

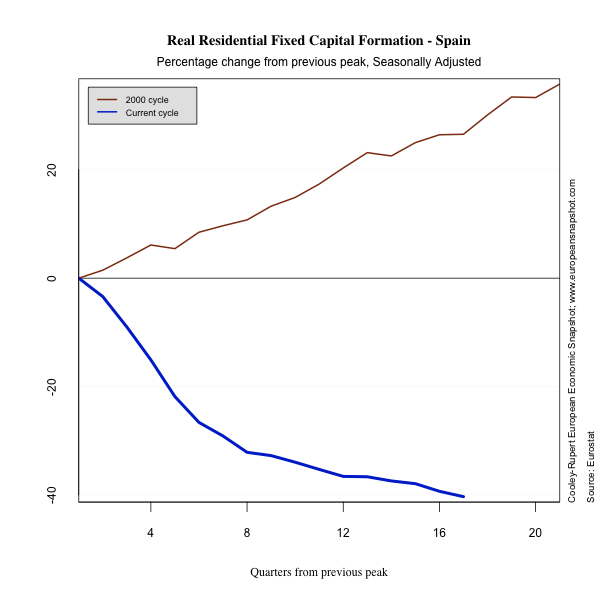

Consumption in Spain has fallen more or less steadily from the onset as has capital formation and residential capital formation. The latter is particularly dismal because of the bursting of the great housing bubble.

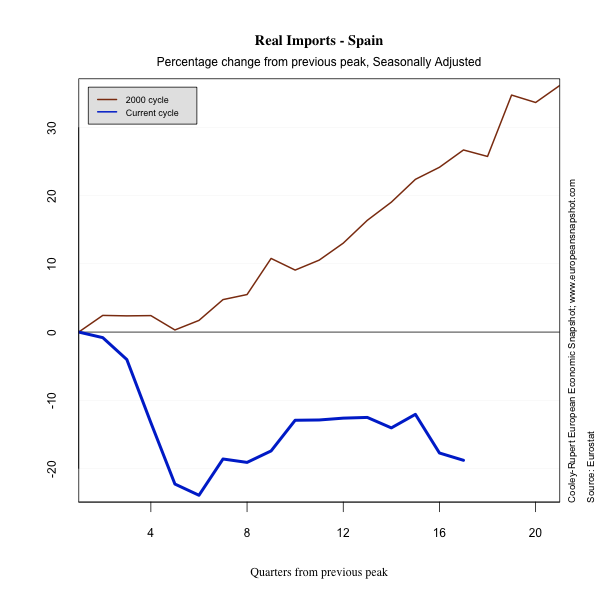

The one bright spot for Spain has been the increase in exports following the initial drop. Imports have not recovered.

The Role of Government

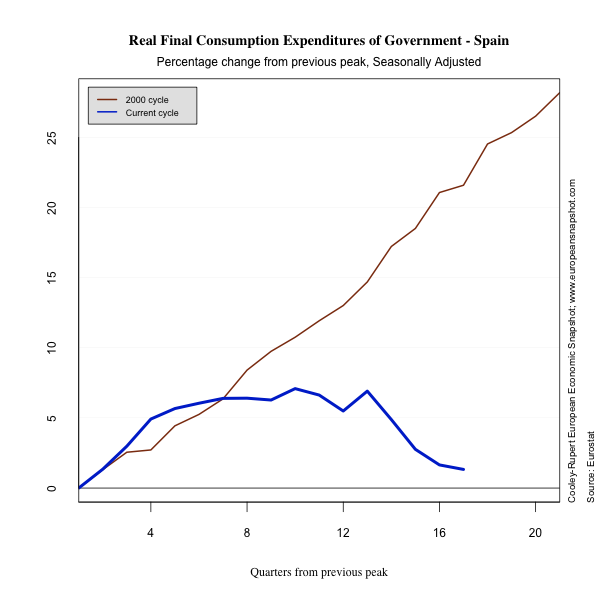

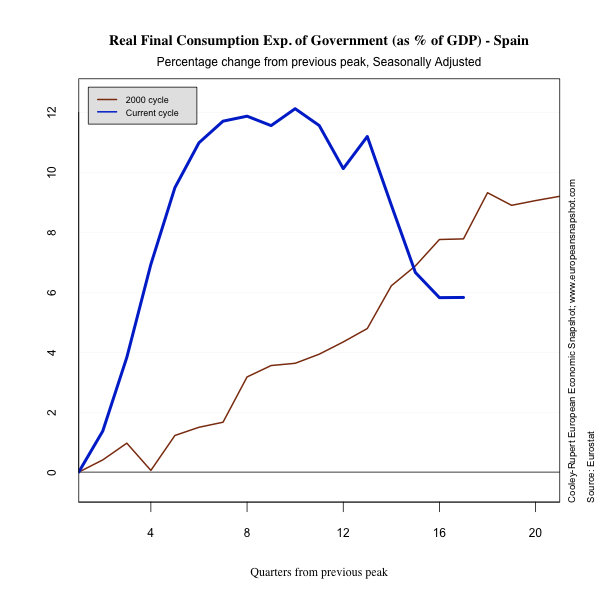

The Spain entered the Great Recession with a modest level of outstanding federal debt but enormous household debt and a banking system weakened by the housing collapse. The figure below shows the response as measured by the percentage change in government consumption from the peak of the cycle to the present. This essentially captures the level of Government spending. The following figure shows government consumption as a percentage of GDP.