The Robust Recovery in Germany

Germany - A Country Apart

On this page we present the salient features of the German Economy since the onset of the Great Recession in historical perspective, where the comparison is with the prior business cycles that we identify in Germany given available data. We able to identify three cycles.

The first figure below shows the path of Real GDP and the estimated trend component (see the page on Identifying European Business Cycles) which is the basis for our analysis.

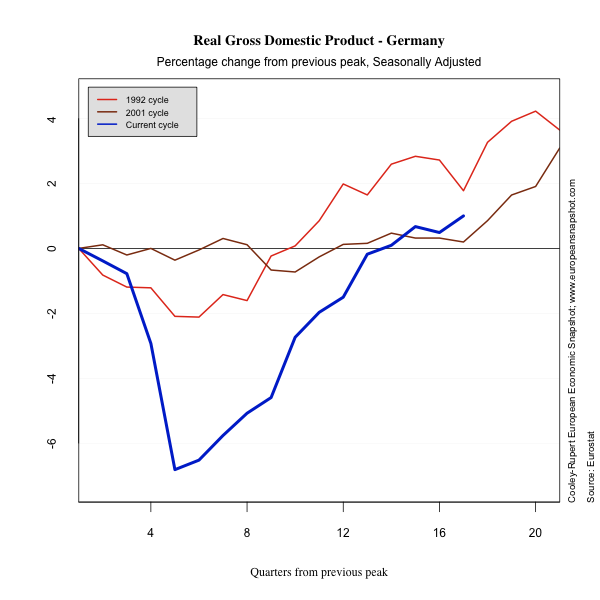

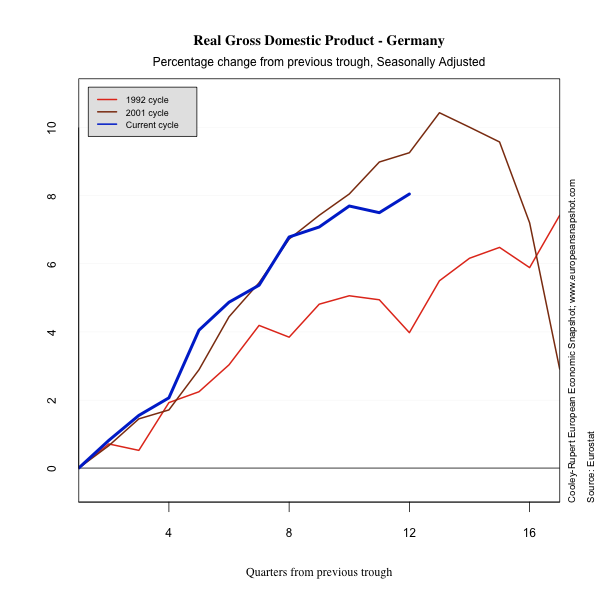

The Great Recession hit the German Economy very hard with a more than six percent decline in GDP and significant financial sector problems. The following graph plots the percentage change in Real GDP for Germany. What is remarkable about Germany and different from virtually all the other European economies is how quickly they rebounded from what was a significant decline.

Looking at the recoveries from the trough shows much the same message.

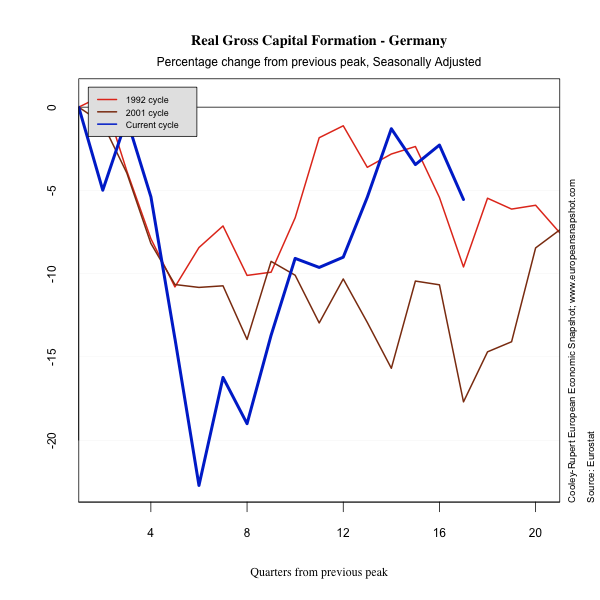

Consumption in Germany has been remarkably constant through the decline and has rebounded more recently. Capital formation though has still not recovered completely. Residential capital formation has recovered.

German exports collapsed sharply but now have recovered as well as in previous cycles. Imports have increased rapidly.

The Role of Government

The German economy entered the Great Recession with a healthy fiscal position but a lot of exposure to the financial crisis and to foreign banks. Germany has preached a doctrine of austerity to other European economies with significant fiscal problems. The figure below shows the fiscal response as measured by the percentage change in government consumption from the peak of the cycle to the present. This essentially captures the level of Government spending. The final figure shows the change in government spending as a percent of GDP. Because GDP declined sharply this increased sharply at the beginning of the downturn.