Economic Recovery in France

On this page we present the salient features of the current recovery in French Economy since the onset of the Great Recession in historical perspective, where the comparison is with the prior business cycles. We identify four business cycles in France given available data and the methods described elsewhere on our page. Two of the cycles seem mild and do not show substantial declines in Real GDP.

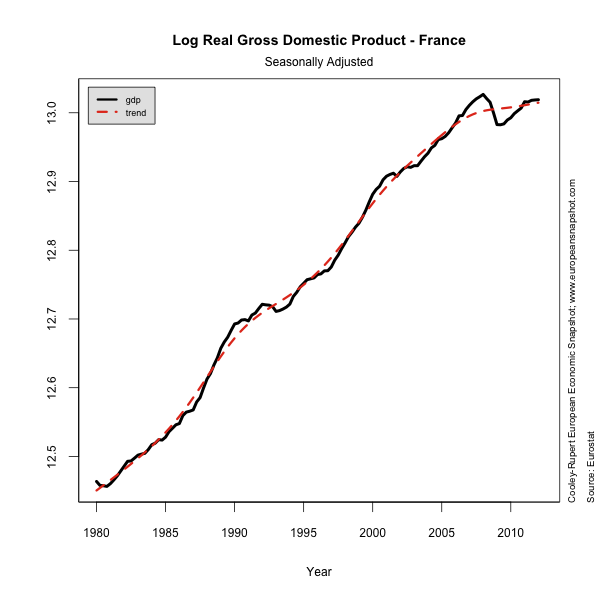

The first figure below shows the path of Real GDP and the estimated trend component (see the page on Identifying European Business Cycles) which is the basis for our analysis.

The Great Recession caused a substantial contraction in the Frency Economy. Real GDP declined by more than four percent, stayed flat for several quarters, increased very slowly for two years and is now flattening again, still short of the previous peak. The following graph shows the path.

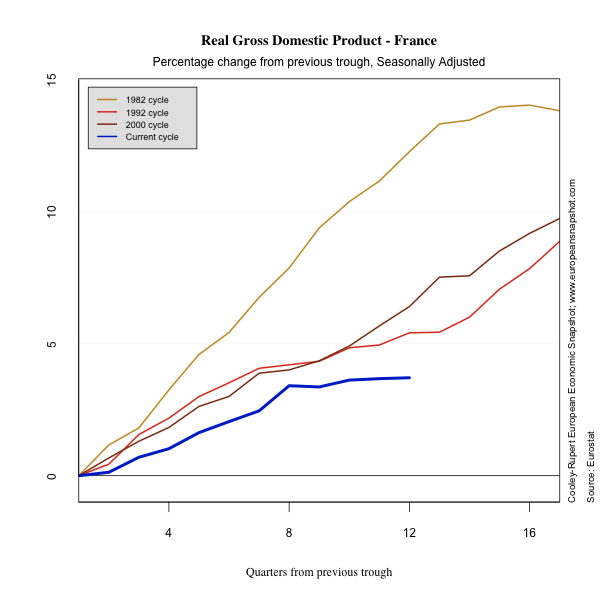

Looking at the recoveries from the trough conveys much the same message with this recovery advancing much more slowly than prior business cycles and threatening to sink back into recession.

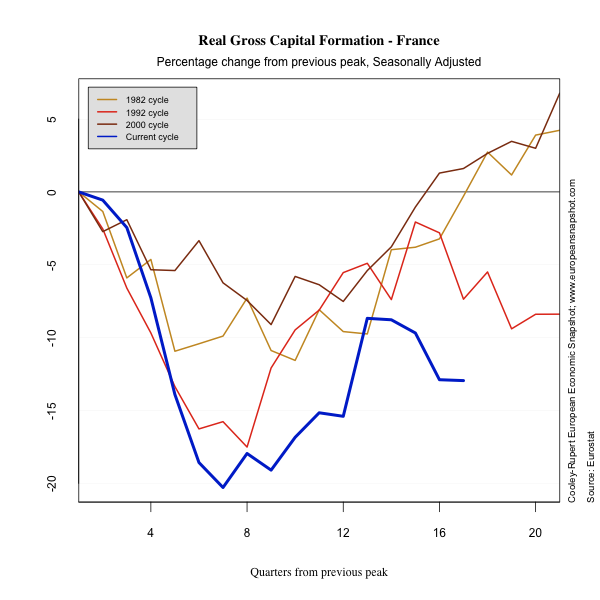

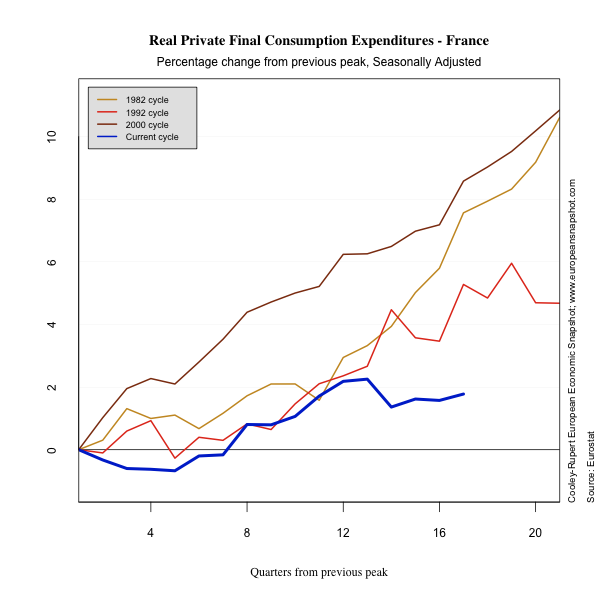

Consumption in has recovered remarkably well but is growing more slowly than the historical experience would suggest.. Capital formation recovered for a while but is now sinking sharply. Residential capital formation fell more than 15 percent from the peak and shows no sign of recovering.

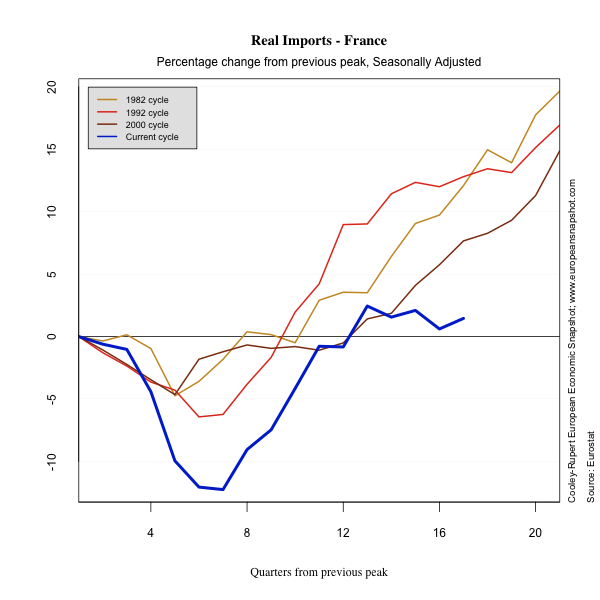

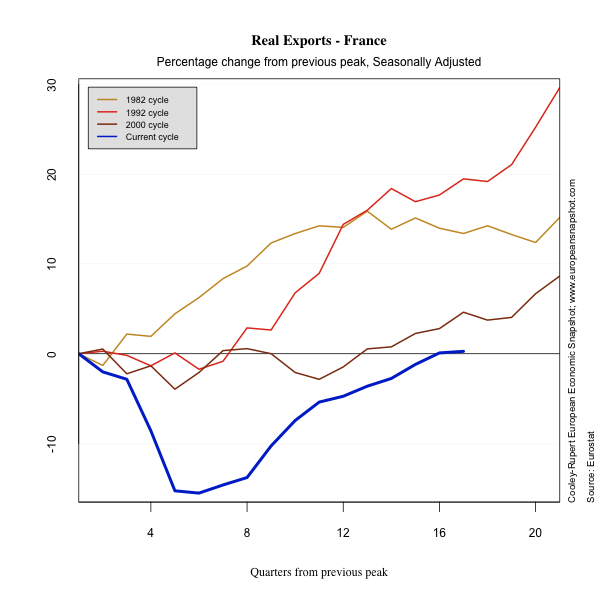

French exports collapsed sharply and have recovered slowly. Imports have rebounded relatively quickly.

The Role of Government

The French entered the Great Recession with a significant and increasing stock of outstanding debt, but only moderately above Maastricht Treaty targets. The figure below shows the response as measured by the percentage change in government consumption from the peak of the cycle to the present. This essentially captures the level of Government spending. The final figure shows the change in Government Spending as a percent of GDP. Because GDP declined sharply this increased sharply at the beginning of the downturn.