Continuing Economic Decline in Italy

On this page we present the salient features of the Italian Economy since the onset of the Great Recession in historical perspective, where the comparison is with the prior business cycles. Given the available data we identify three cycles.

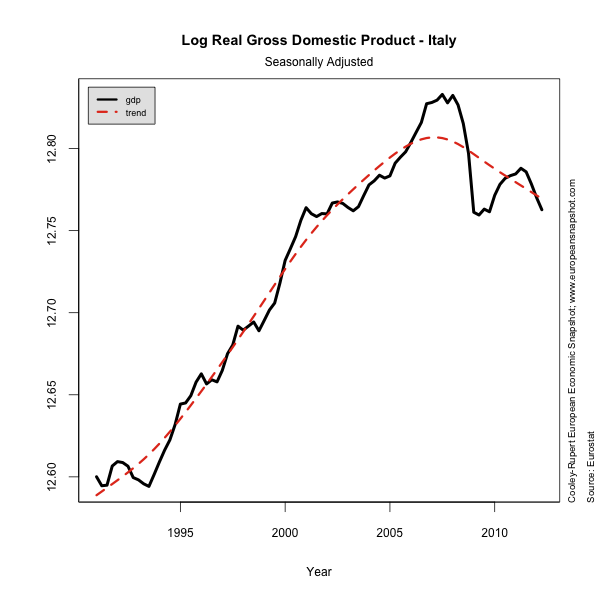

The first figure below shows the path of Real GDP and the estimated trend component (see the page on Identifying European Business Cycles) which is the basis for our analysis. The decline in Italian GDP is quite remarkable and the figure illustrates the impact of extreme end points on the estimated trend component.

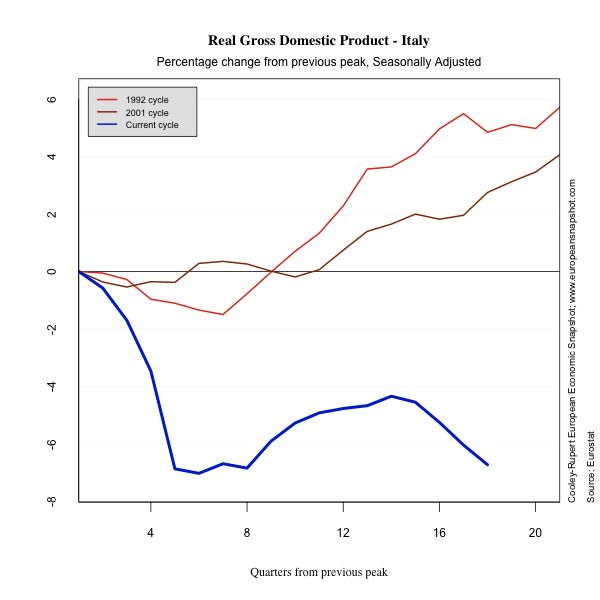

The Great Recession hit the Italian Economy very hard with a more than seven percent decline in GDP. Italy had significant fiscal problems at the beginning of the downturn and a record of low or no productivity growth for the prior decade. The Great Recession seems to have exacerbated those weaknesses. The following graph plots the percentage change in Real GDP for Italy. What is remarkable about Italy and is worse than most other European economies is that it has not recovered very much and is now headed rapidly lower again.

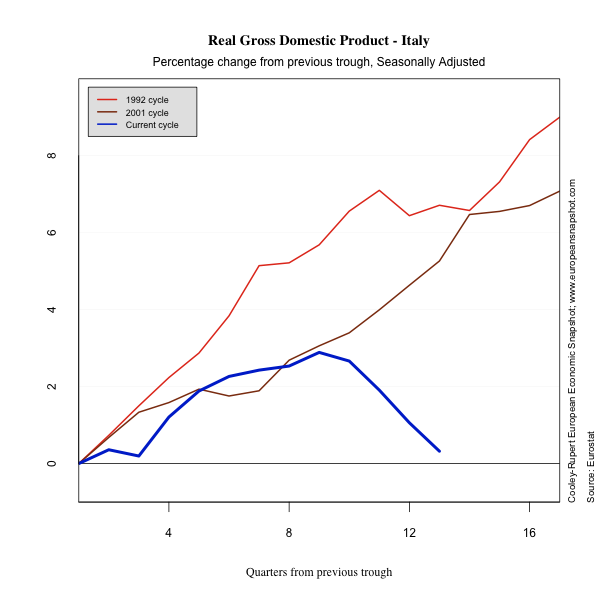

Looking at the recoveries from the trough shows much the same message.

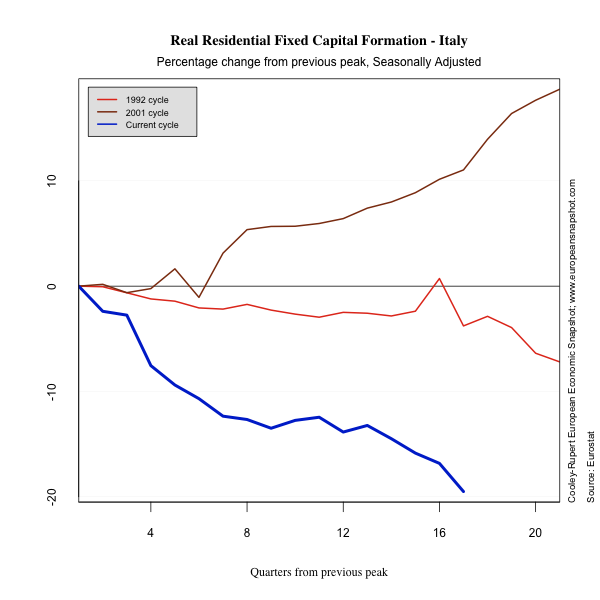

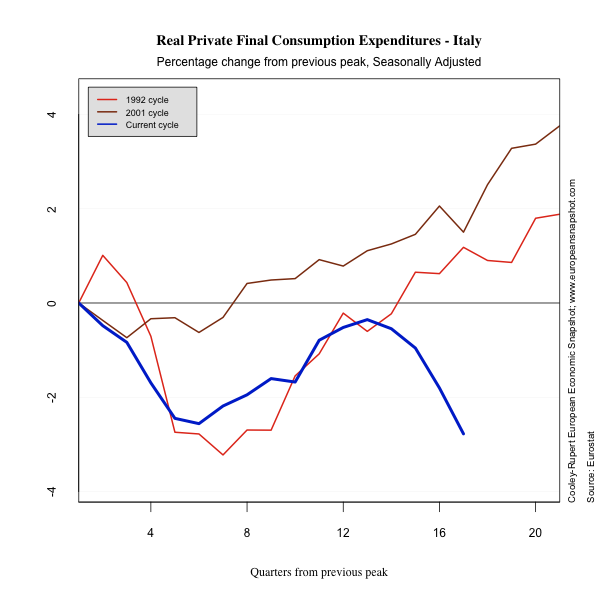

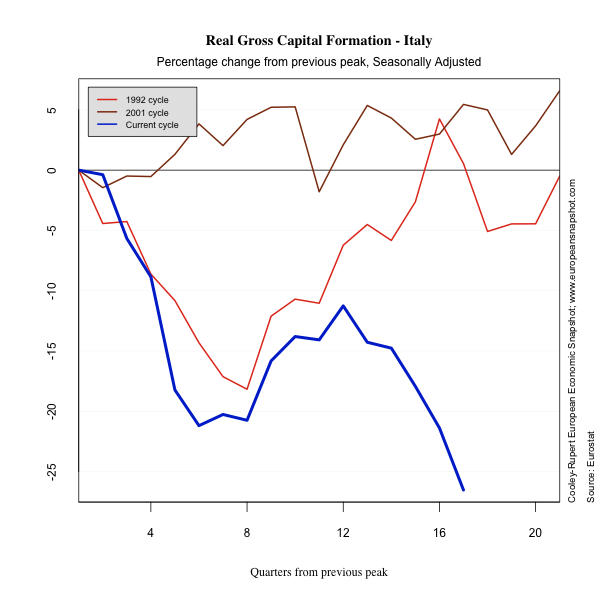

Consumption in Italy recovered for a while but is now collapsing again. Capital formation began to recover after 8 quarters but has since collapsed dramatically. Residential capital formation has declined steadily.

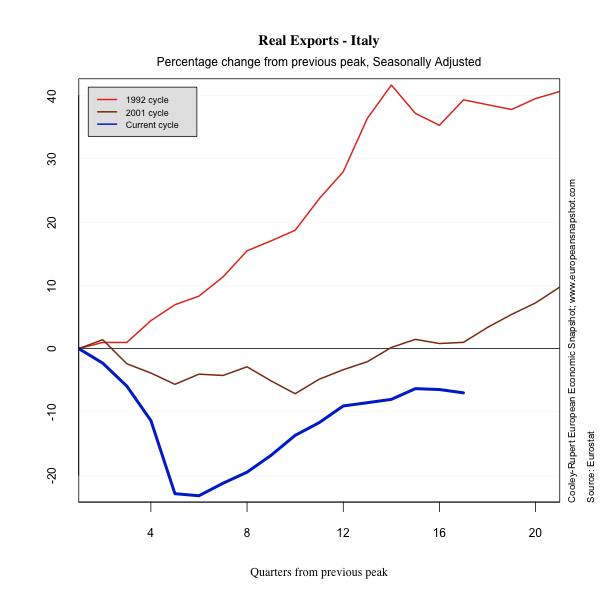

Italian exports collapsed by more than 20% but has since recovered slowly. Imports rebounded and then collapsed again.

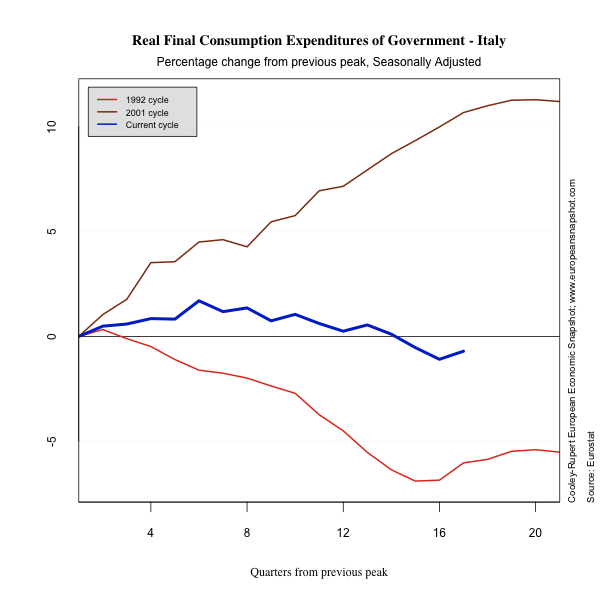

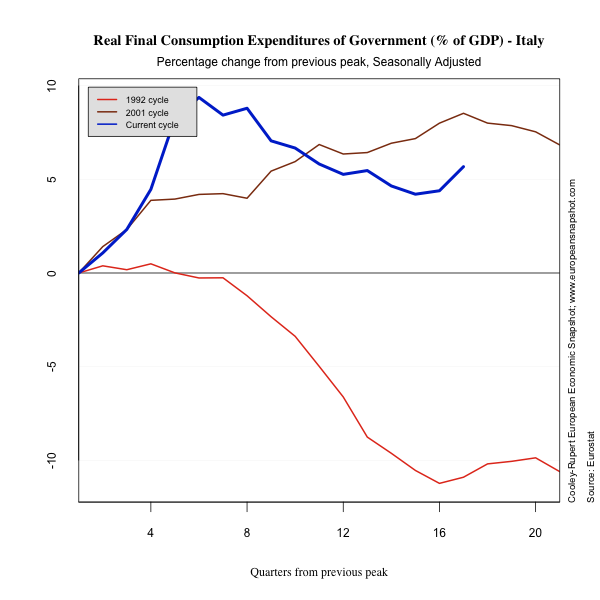

The Role of Government

Italy entered the Great Recession (and joined the Eurozone) with a very large stock of outstanding debt. Their desire to keep their primary deficit under control gave them when it came to Governments response to the Great Recession, a position that was exacerbated by political instability. The figure below shows the response as measured by the percentage change in government consumption from the peak of the cycle to the present. The final figure shows the change in Government Spending as a percent of GDP. Because GDP declined sharply this increased sharply at the beginning of the downturn.