by Thomas Cooley, Ben Griffy and Peter Rupert

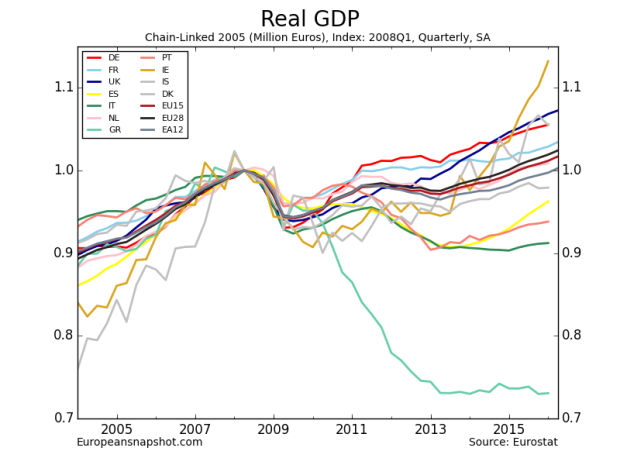

Eurostat released estimates of first quarter GDP for the Eurozone a little over a week ago (here), showing modest growth of 0.5% for the more inclusive measure of European countries. This is the 12th quarter in a row that the Eurozone has exhibited positive growth after suffering nearly two years of negative growth 2011-2013. The truth is, however, that the Eurozone has only barely recovered to its pre-recession levels. Furthermore, this growth has been driven by core economies, with countries on the periphery still years away from a full recovery.

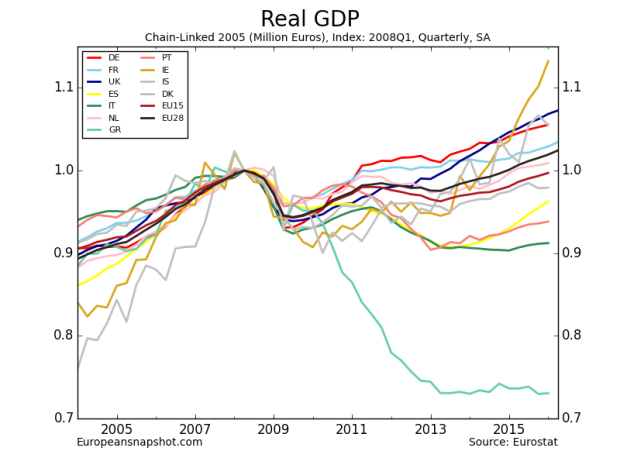

As usual, disaggregated data is not yet available for all countries from Eurostat. As we see from the most recent set of available data, a number of countries have recovered beyond their 2008 peaks:

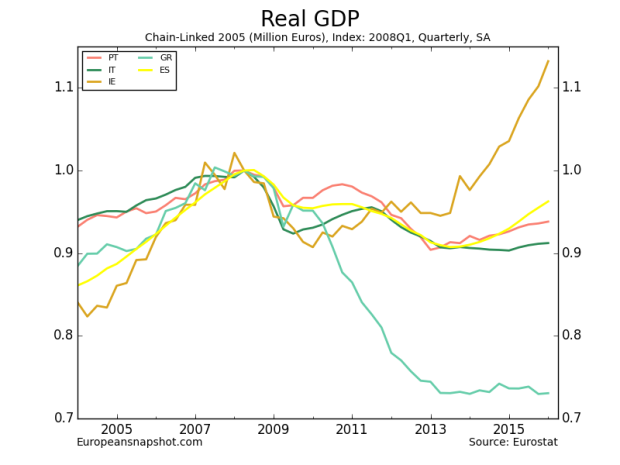

Notably, the large economies of the UK, France (and Germany, though we don’t have the data) are pulling measures of Eurozone health (EU15, EU28, EA12) up above their pre-recession highs. While this is notable, the smaller periphery economies are still lagging well behind. Focusing specifically on these economies (Portugal, Ireland, Italy, Greece, and Spain), we still see an inadequate recovery:

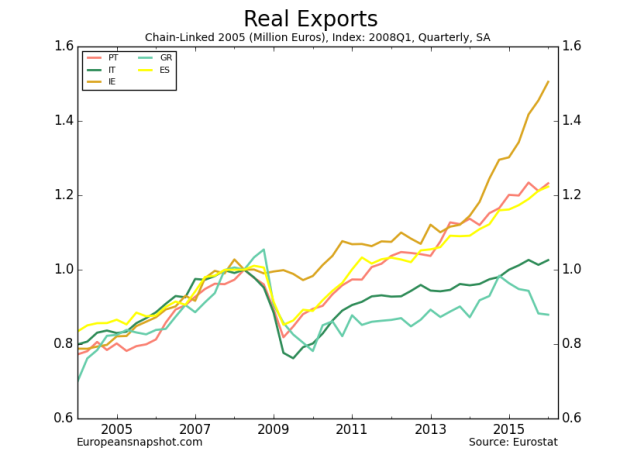

Greece can only be termed a tragedy at this point; with the exception of Ireland, the rest of the periphery economies are still lagging behind their 2008 peaks. Spain and Portugal have both made substantial recoveries over the past year, and are approaching their pre-recession levels. Much of this recovery has come through a rise in net exports, shown in the following two graphs:

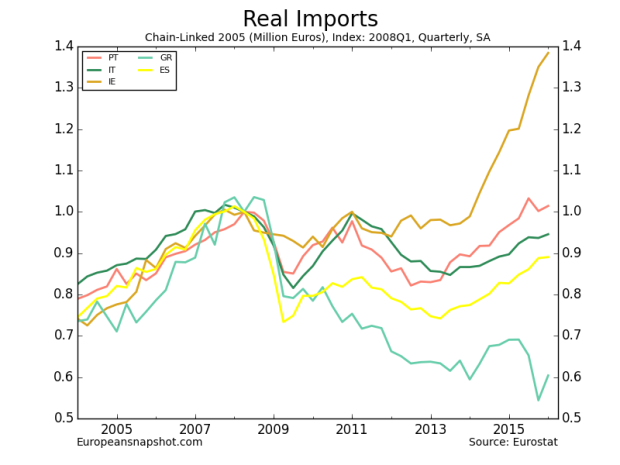

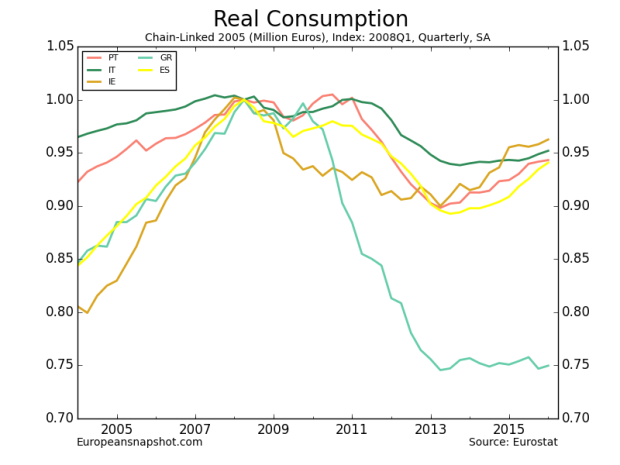

But has not translated into increases in consumption, as each economy is still substantially below their pre-recession levels:

Additionally, there has been much discussion about the UK leaving the Eurozone. Leaving aside the merits of such a decision for the UK, we wanted to demonstrate their importance to the interpretation of the recovery of the Eurozone. When we remove the UK from the Eurozone and recalculate aggregated recovery statistics, there is a stark difference:

The series “EU15” is here recalculated without the inclusion of the UK. As of 2015Q4, the Eurozone would still be lagging behind their pre-recession levels.

Broadly, while the Eurozone has seen a lot of recovery over the previous year, there is still cause for concern. Namely, the recovery has been very uneven: the periphery economies have seen very little of the growth accrued among the large central economies in the EU (UK, France, Germany, etc.). Furthermore, if the UK were to leave the Eurozone, we would not be talking about this as a remarkable recovery; we would still be describing the tentative recovery of a few core countries, while the rest of Europe lags behind.