by Thomas Cooley, Ben Griffy, and Peter Rupert

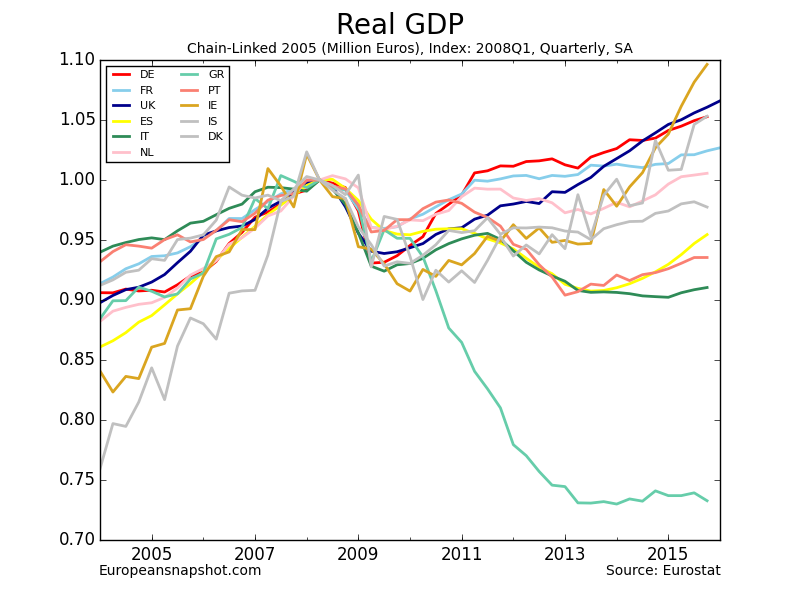

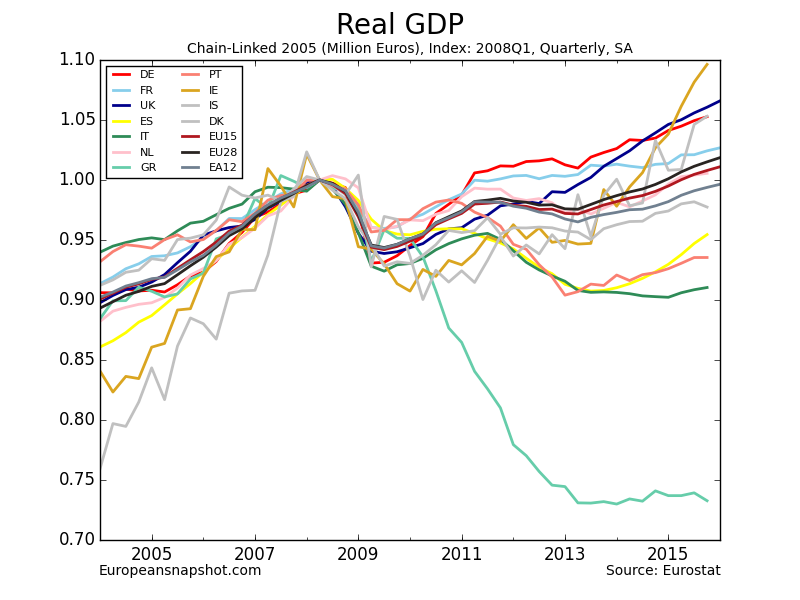

Fourth Quarter data for 2015 were released this morning by Eurostat. As usual the details for individual countries are lagging behind but the larger picture is clear: the economic recovery in Europe is progressing more slowly than policymakers had hoped, but there are signs of promise. The EU 19 Countries grew at a combined rate of 0.3% which means that the EU grew at roughly 1.5% for the year just past. This is not a hugely encouraging outcome given the aggressive stimulus of the ECB, and the efforts that have been made to improve the soundness of their banks and unify the banking system. But Europe has been beset by terrorist attacks and a refugee crisis as well as a difficult economic environment elsewhere in the world, so slower than expected growth is perhaps not surprising.

As has been true for some time, the aggregate growth results reflect some very different experiences with the U.K., Germany, and now at last Spain growing well, while many of the other countries are flat-lining. Even leaving out the tragedy of Greece, the economic fortunes of the European partners have been very mixed. Europe as a whole has barely returned to 2008 levels, with a number of the peripheral economies still nearly 10 percent below their pre-recession output levels. Is the recent improvement strong enough to warrant optimism? The EU’s trade with China is significant - slightly larger than the United States’ trade with China. Exports to China were $211 billion in 2014. With China slowing down and the Yuan falling this presents a gloomier outlook for Europe. In addition, the recent weakness of the European banks is another danger signal.

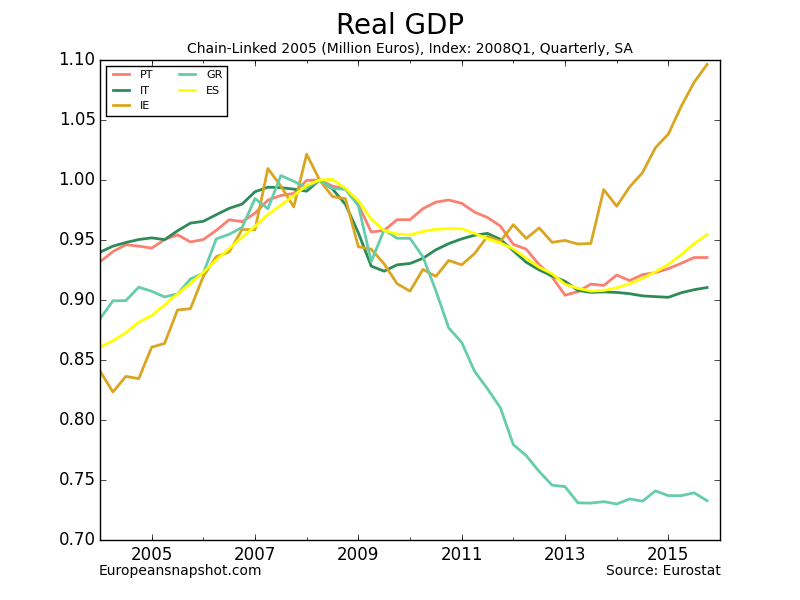

If we focus in on some of the larger economies there is at last cause for optimism about a European recovery: even Spain and Italy have returned to growth in the most recent data, although they remain far below their previous levels.

If we focus in on some of the larger economies there is at last cause for optimism about a European recovery: even Spain and Italy have returned to growth in the most recent data, although they remain far below their previous levels.

The so-called PIIGS-the periphery economies-are a different story but also an improving one. Ireland, Spain, and possibly Portugal are showing signs of growth.

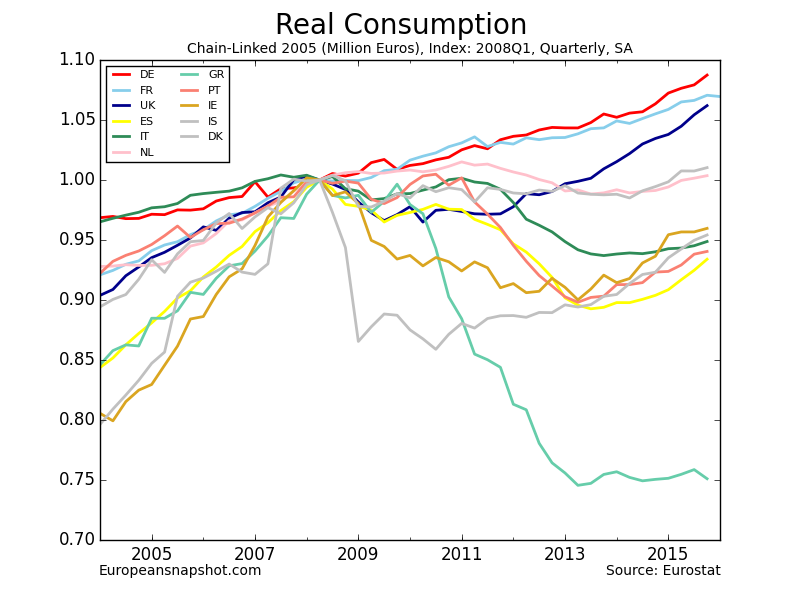

Consumption shows much the same picture, but most countries have not returned to anything like their previous peak levels in most economies.

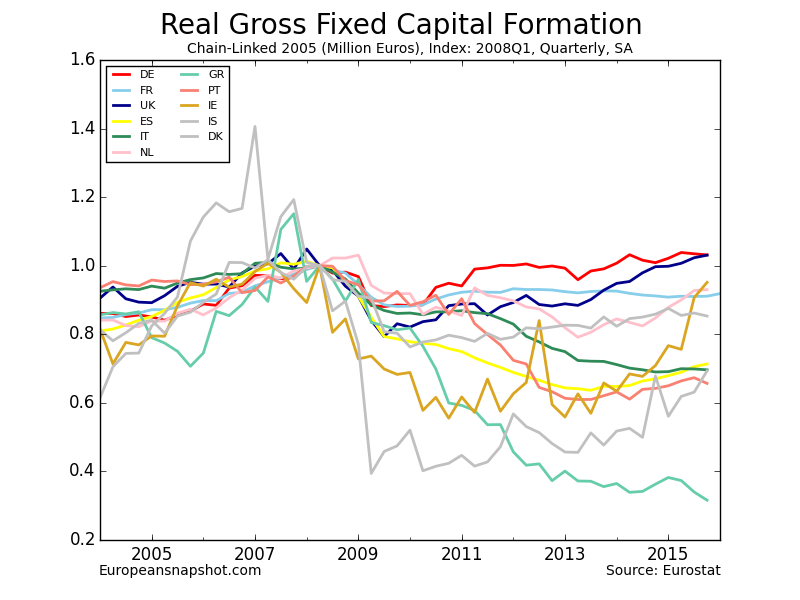

Investment has been very slow to recover in most of the countries and seems to be a major obstacle to recovery in the weakest economies, with several still 20-40% below the 2010 peak. This seems unlikely to improve rapidly, given the unwillingness of firms to invest in an uncertain economic environment.

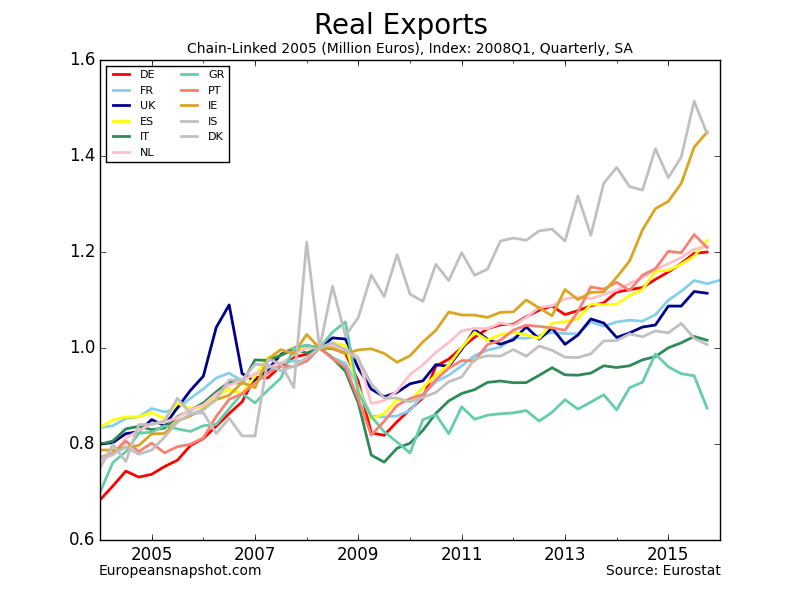

Exports were showing strong signs of recovery but they have turned down almost everywhere - a sign of the influence of a slowing China and disastrous downturns in Russia, Brazil, and elsewhere. What should have been helped by a weaker Euro has been hampered by the recent strengthening of the Euro and looser monetary policy on many fronts.

Overall, the tragedy of Greece does not seem to be impeding a gradual European recovery. Although the countries are improving at very different paces, the fact that growth has returned more broadly has damped a lot of the dire speculation about the future of the EU. Global concerns will shape much of the outlook for the Eurozone going forward, but the data suggest that most economies in the EU have returned to growth, with larger economies having exceeded their pre-recession levels of output, while the peripheral economies have begun to show signs of recovery.