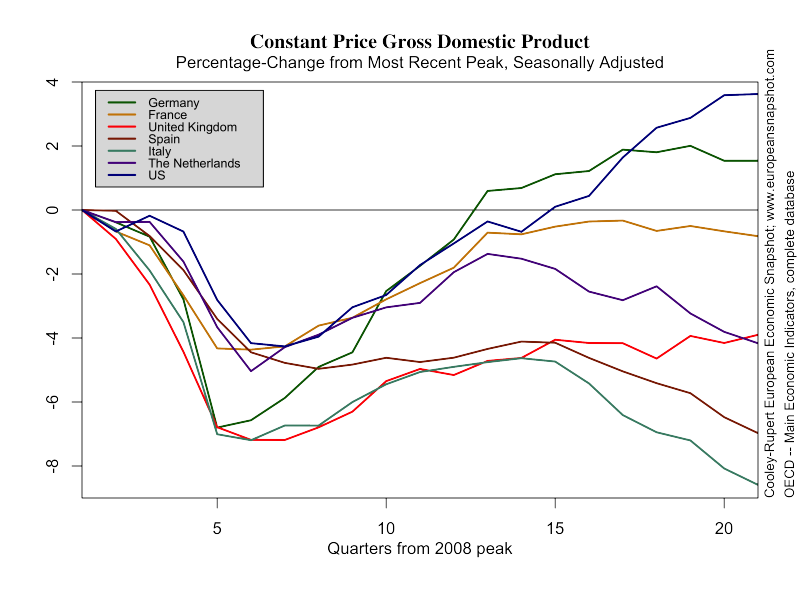

There has been much celebration in the media of the fact that several European economies showed positive growth in the Second Quarter of 2013 based on the most recently released data from Eurostat. If this upward trend was widespread and robust this would indeed be encouraging news because virtually all of Europe has been suffering from a double-dip recession (Germany, UK, and France being moot) following the financial crisis of 2007-2009.

GDP

The latest data from Eurostat shows Real GDP increasing for the biggest economies - Germany, France, and the U.K. The flash estimates of quarter-to-quarter growth rates also suggest an up-turn in Portugal. But Spain Italy and The Netherlands are still declining, suggesting that the optimism should be seriously moderated.

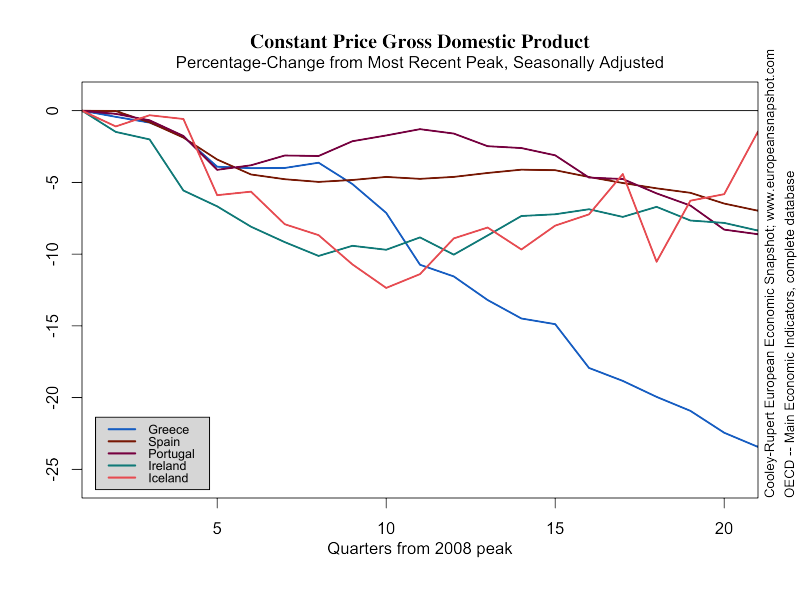

In this post we also show the path of the percentages changes in Real GDP for the so-called PIIGS or GIPSIs. The picture for these economies is decidedly more bleak. Only Iceland is showing signs of recovery while the others continue to contract with little sign of moderation. Also worth noting is the scale of the graph for the smaller economies which underscores how much deeper the contraction in these economies was.

Looking at all of these economies together it would take a colossal leap of the imagination to see this as a picture of recovery, as was widely reported last week.

GDP Components

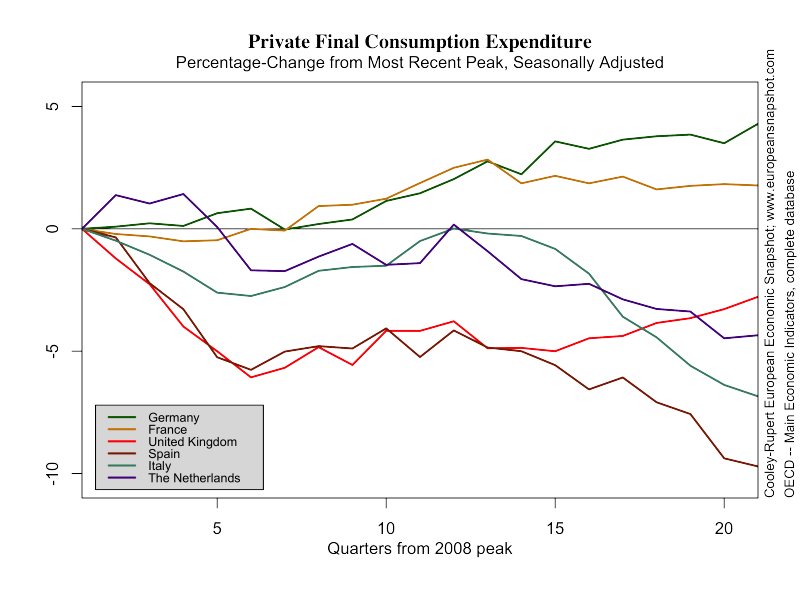

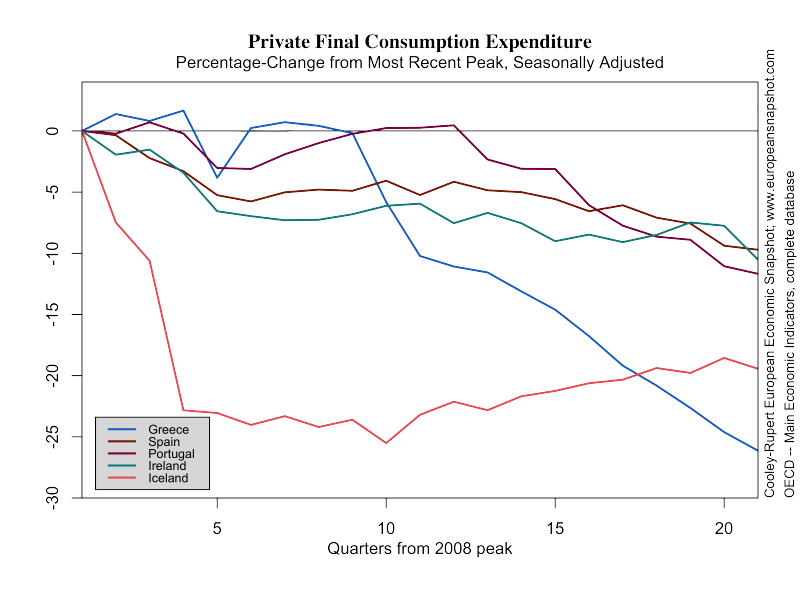

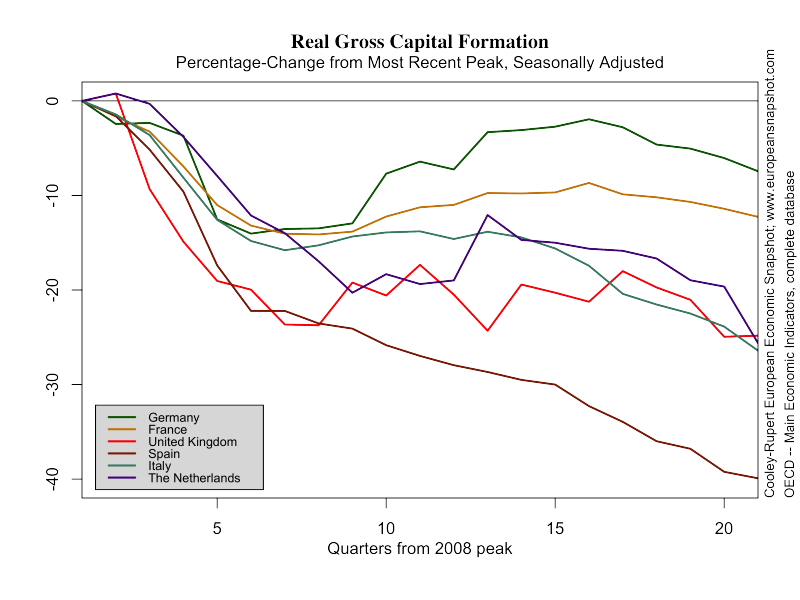

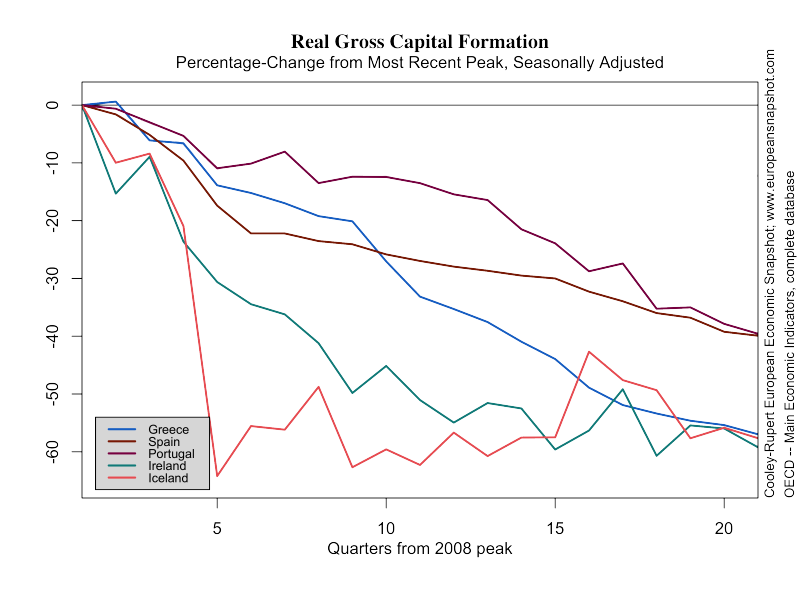

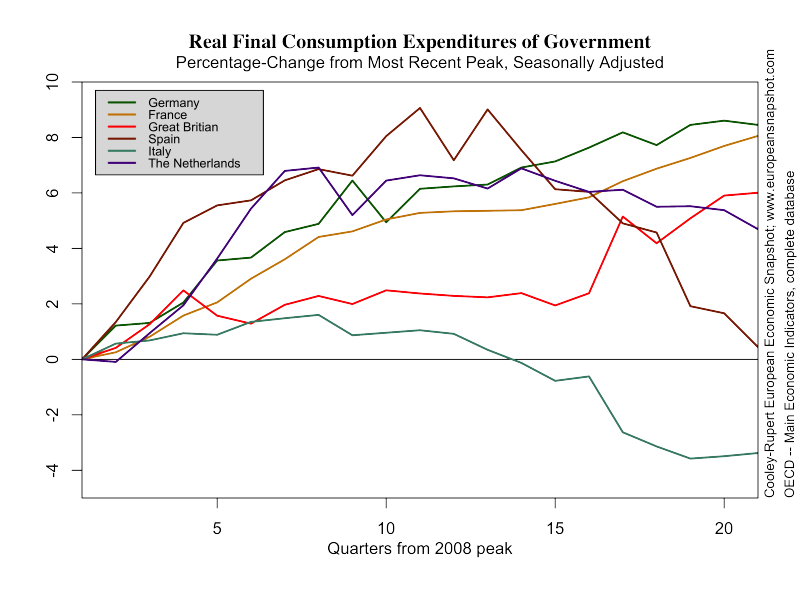

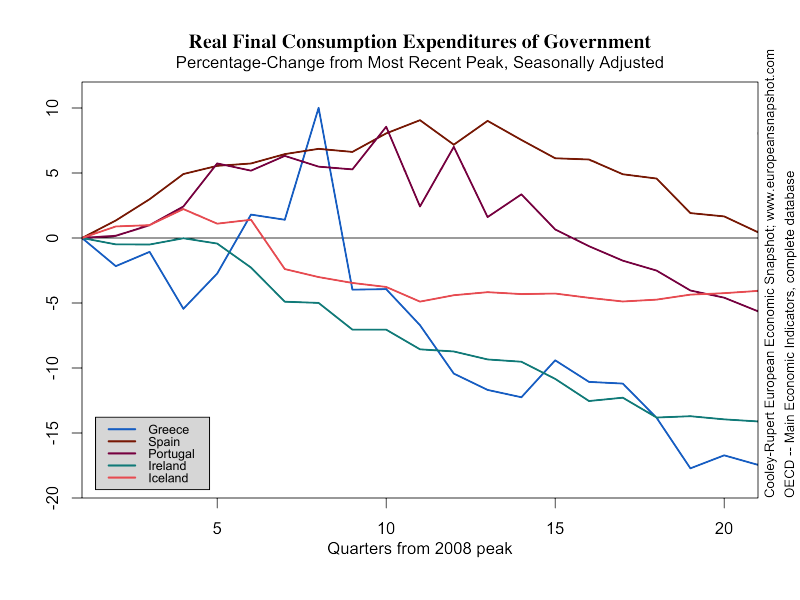

The pattern of consumption in the major European Economies pretty much mirrors the pattern of GDP. One exception is France, where consumption fell very little during the recession and has since recovered. The decline in consumption in the GIPSIs has been deep, reflecting the tremendous toll of the continuing fiscal crisis. Perhaps more alarming is the continued double-dip decline in capital formation in all of the European economies. This hardly seem like a signal of impending recovery.

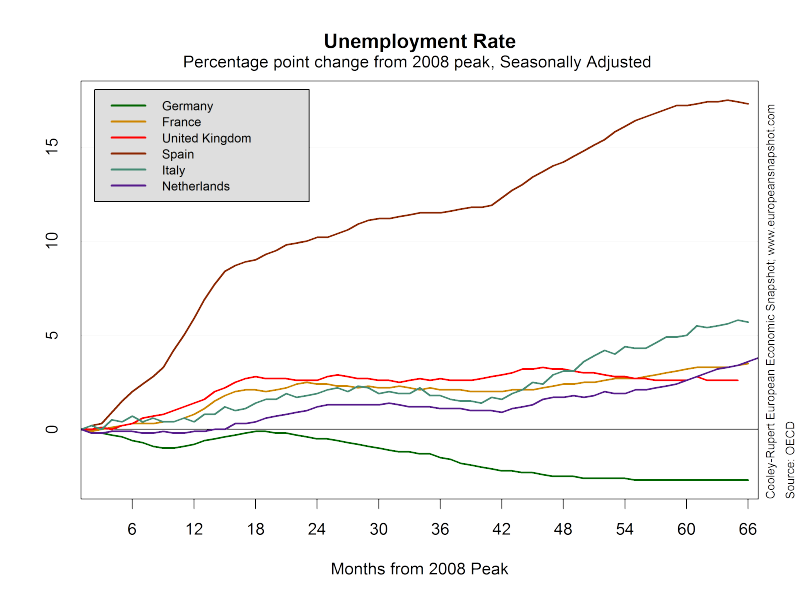

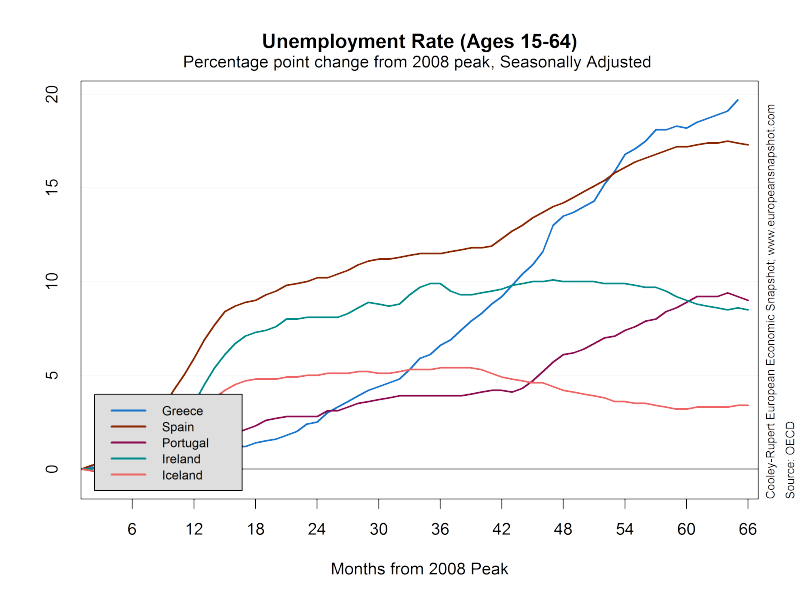

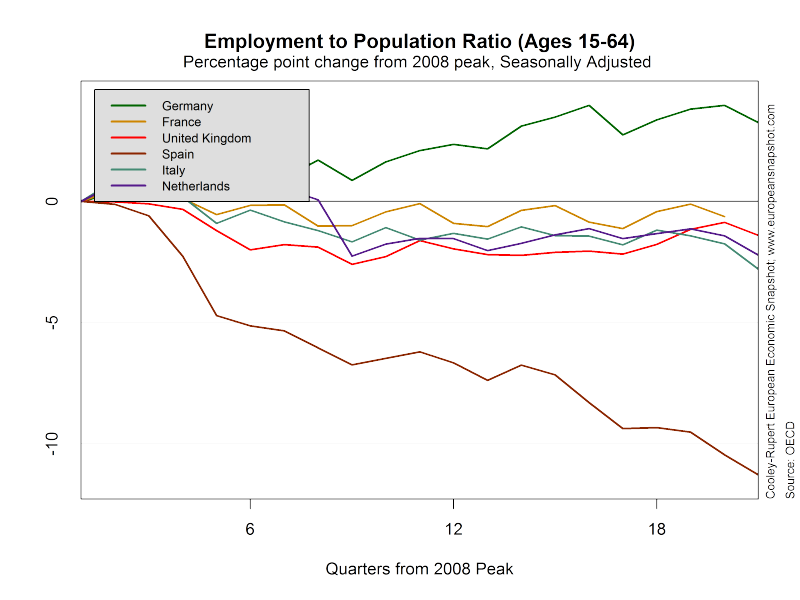

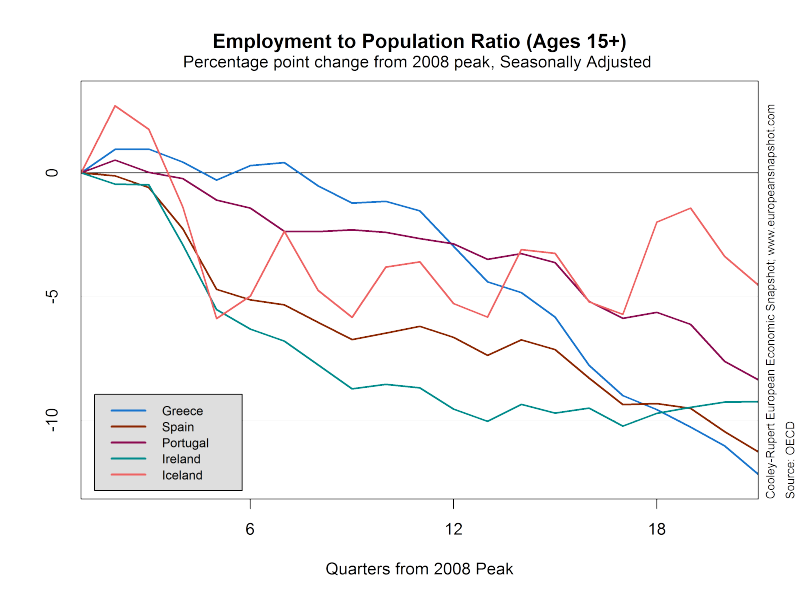

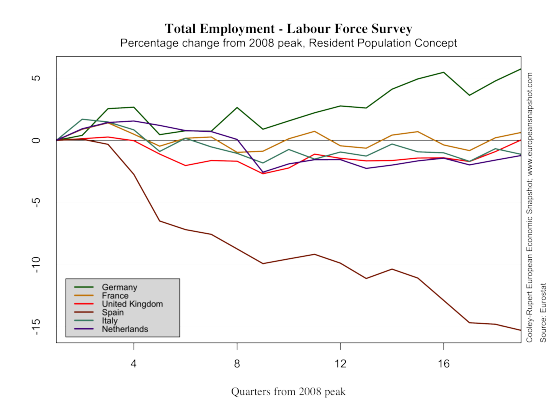

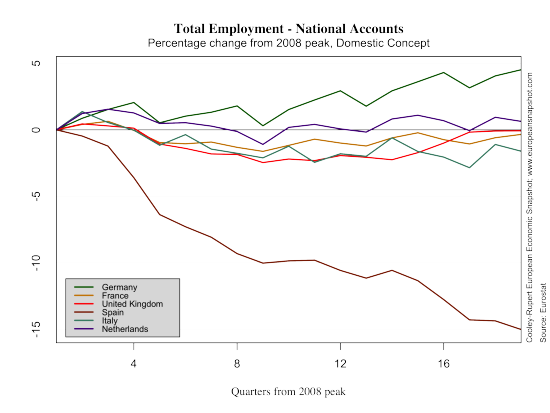

LABOR MARKETS

If it is difficult to see signs of recovery in the data for GDP and its components, it is equally difficult to see it in labor markets. Perhaps the good news is that the unemployment rate is no longer rising in Spain, the U.K. and France. It is also falling somewhat in Ireland and Portugal. But many of these countries are now stuck at levels of unemployment that will take a generation to moderate given the sclerotic state of European labor markets. The employment/population ratio is also falling across the board. Some of this reflects the changing demographics of the population but mostly it reflects the state of the post-crisis European Economy.