By Thomas Cooley, Charlie Nusbaum, and Peter Rupert

Eurostat recently released estimates of first quarter GDP for the Eurozone and other EU member nations showing GDP growth of approximately 0.6% (here). Indeed, GDP growth rates increased by 1.9% and 2.1%, respectively, relative to the same time last year. In light of these promising, albeit modest, gains for Europe, we reexamined the Three Europes detailed in a previous post. It now seems that Europe is on a new somewhat brighter path with many countries experiencing renewed growth. To be sure many countries remain below pre-crisis output levels but they have in fact begun to grow.

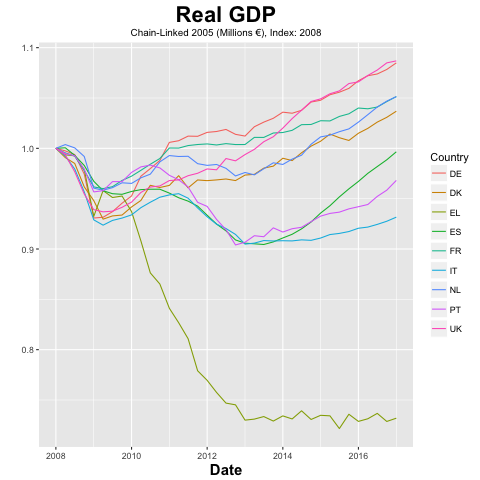

The economies of Germany, the Netherlands, and Denmark all remain strong, exceeding their pre-crisis output levels by 3.5%-8.5% with average quarterly GDP growth rates of 0.3%-0.8% since 2014. Moreover, Spain’s growth rate has far exceeded that of any of the northern economies for quite some time now and is on track to catch up with the North should trends continue. Portugal’s economy seems to have gained steam as well while France and Italy continue to see meek growth. The big exception is still Greece which has not yet been resuscitated and remains flatlined roughly 27% below its pre-crisis output. As with previous posts, we have omitted Ireland because it swamps the data and is a bit distorted by the way foreign intellectual capital affects the national accounts.

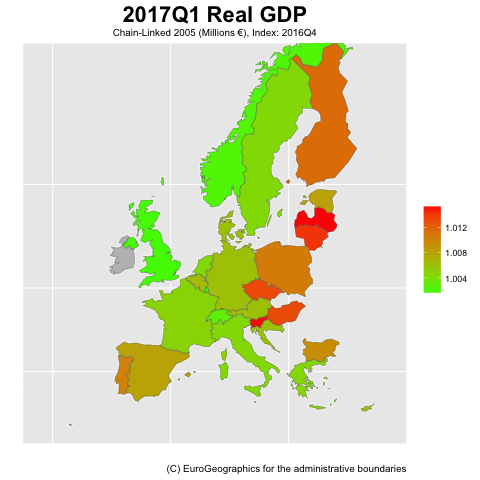

First quarter trends are perhaps most easily seen geographically. Here, we see that first quarter European growth has largely been driven by Spain, Portugal, and the Eastern EU countries. Surprisingly, growth in the United Kingdom lagged behind virtually all other member nations since the start of 2017.

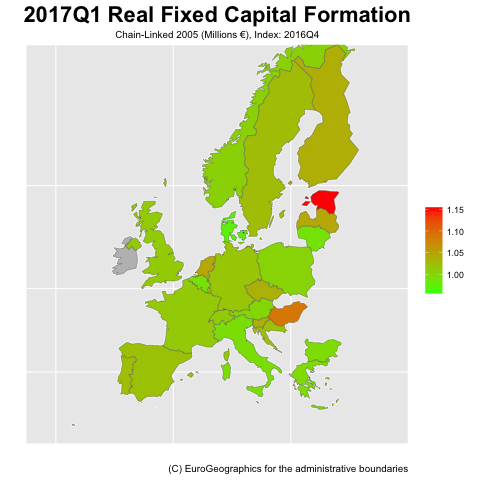

Moreover, while we can be less certain regarding growth in the next few quarters, we expect these longer term trends to continue or even improve. Indeed, fixed capital formation, the key to economic growth, increased in most countries during 2017Q1 relative to 2016Q4. Capital formation in Greece and Italy seems largely unchanged from the end of 2016, indicating that their growth trends are likely to remain lackluster absent other major interventions going forward.

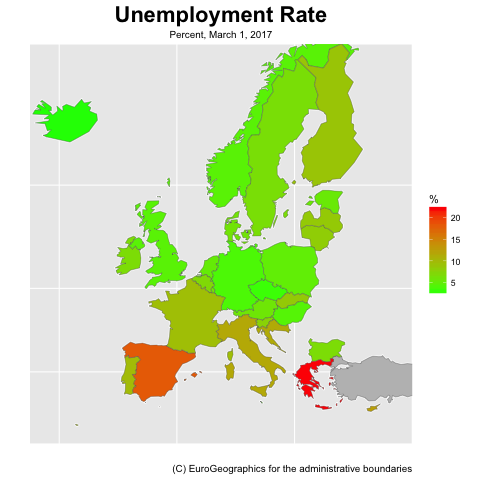

From a labor market perspective, the Tail of Three Europes continues into 2017. Here, we report the March unemployment numbers as Eurostat has yet to update this indicator for all countries of interest. We see that those countries in the North have the lowest unemployment rates and those in the South have the highest, while Central Europe is somewhere in between. Relative to the end of 2016, however, unemployment has decreased in all countries but Denmark, where the unemployment rate is roughly the same as the end of 2016.

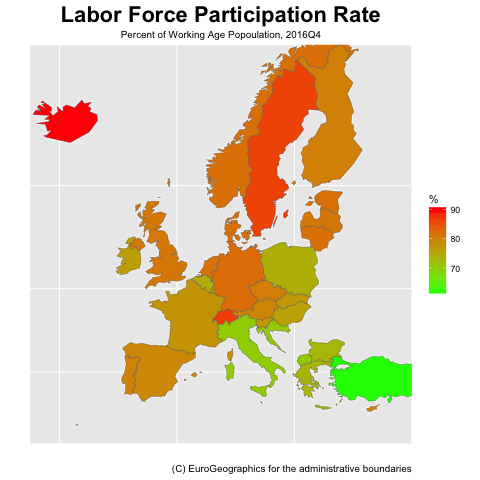

Labor force participation does not seem to follow the same stark geographic trends as unemployment. Here again, 2017Q1 numbers are not yet available for many countries of interest. Instead, we present 2016Q4 numbers. Iceland is the clear winner, with over 90% of its working age population either working or looking for work. Coupled with its low unemployment rate, the labor market in Iceland seems to be the strongest in the Western World. While Iceland is the clear winner, and Turkey and Italy seem to be the losers, the virtual boundaries seen above are absent, rather a more gradual gradient appears here. In other words, the differences between those wanting to work in neighboring countries seems to be small.

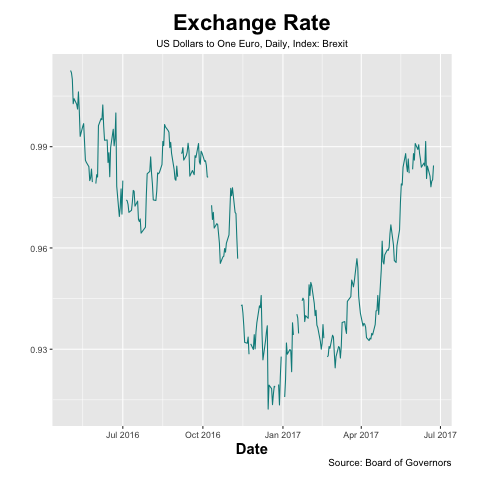

Finally, since the end of 2016, the Euro has regained much of its lost ground relative to the dollar. The “collapse of the Euro” as described by some, has stopped. Perhaps a combination of improving performance and a renewed sense of stability resulting from the polls leading up to the French election- and its outcome- have restored confidence in the Union. While a lot can change over the next 6 months, 2017 is showing signs of a good year for Europe.