by Thomas Cooley, Ben Griffy, and Peter Rupert

It is now less than 12 hours before we hear the final tally on whether to stay or “Brexit” (British Exit) from the economic coalition known as the European Union. Until recently, it looked likely that the UK would remain a member, but recent polling suggests that the likelihood of either outcome is roughly equal (link). While a British withdrawal from the EU might be easier than a member of the currency union, there is still a lot of uncertainty about what the economic consequences might be. It seems fairly certain that given the instability (economically and politically) in Europe, a withdrawal would not be advised at this point. Here, we discuss what might be the outcomes of such a policy.

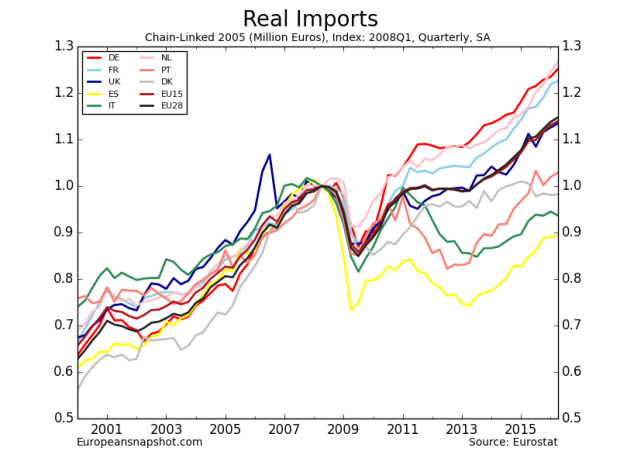

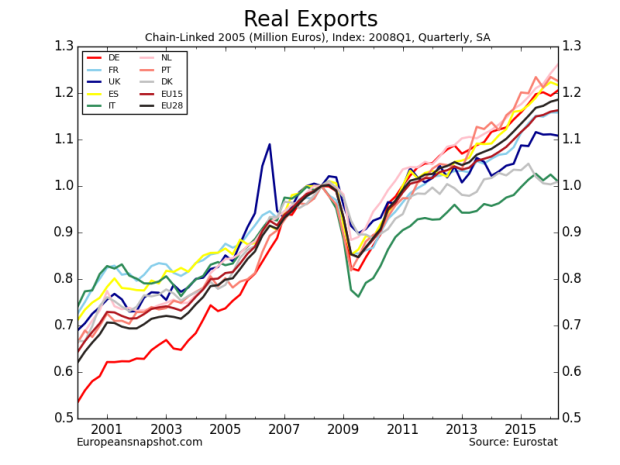

Consequences for the UK: Perhaps least clear is the impact upon the UK from an EU exit. Supporters of the referendum broadly base their argument on fears about new immigrants, the merits of which we will not discuss here, rather than economic principles. There are a some economists who have argued that Brexit would improve the UK economy (see here), but we do not find these arguments credible. The most likely consequence of Brexit is a sharp decline in intra-EU trade for the UK. The UK has been among the most active importers and exporters in the EU for some time:

This second graph is somewhat notable, as the UK has lagged behind many other EU countries during the post-recession period. However, as noted here, the UK has been among the most successful worldwide economies after joining the EU (see “The EU has been good for Britain”). UK economists estimate that GDP could be 1.5 to 3.7 percent lower, with losses in productivity magnifying this loss (link).

In addition, it seems likely that there will be consequences for the UK from the EU directly. The EU could implement sanctions in order to dissuade other economies from leaving, sending the signal that exiting is costly. How large these penalties would be depends upon how strong a signal the leaders of the EU want to send.

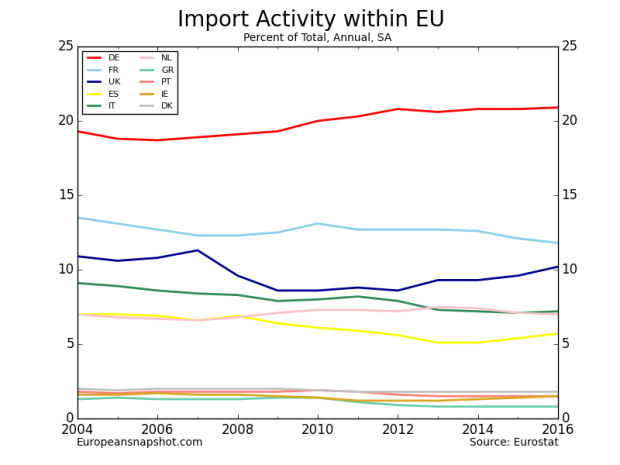

Consequences for Europe: As we discussed in a previous post, Brexit would change the dialogue surrounding the European recovery from the Great Recession. Furthermore, the UK is among the most active importers of goods from fellow EU-member states:

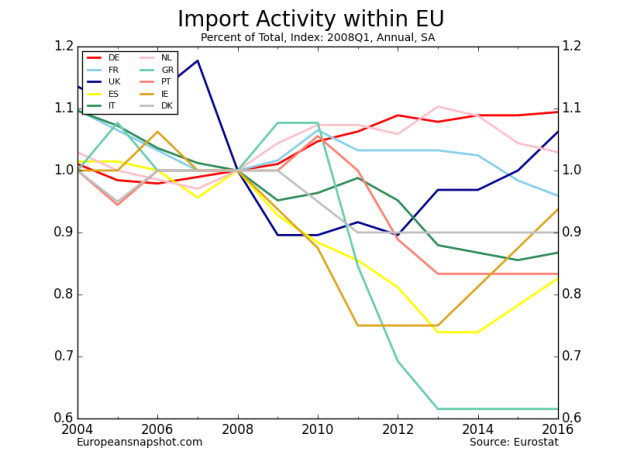

And has driven a substantial amount of the recovery during the post-recession period in exports from within the EU:

A larger concern is that a British exit from the EU could lead to countries like The Netherlands exiting the Eurozone as well which would set of a run for the exits. A UK exit could be a signal to these periphery economies that the time is right, and lead to larger problems for the EU. Broadly, Brexit could signal the beginning of the end for the EU economic coalition.

Consequences for the US: Continued uncertainty has harmed recoveries in the United States, and the possibility of a crisis in Europe has contributed to tepid growth in the US (see our companion blog, here, for more recent analysis of the US economy). The United States is certainly more insulated from the effects of Brexit, but any feedback could be damaging for both the US and Europe. The EU economies aggregated are the largest trading partners of the United States, with Eurozone economies importing nearly 250 billion Euro in US goods, and exporting nearly 400 billion Euro in European goods to the US (link).

The results start rolling in at 7 pm PST, with the final tally coming at 11 pm PST. The vote will be a strong signal for the fate of the EU, and potentially of the global economy.

Update (7pm PT): The Guardian is offering live tallies of votes, along with good statistics on the demographics of counties: here.