by Zach Bethune, Thomas Cooley and Peter Rupert

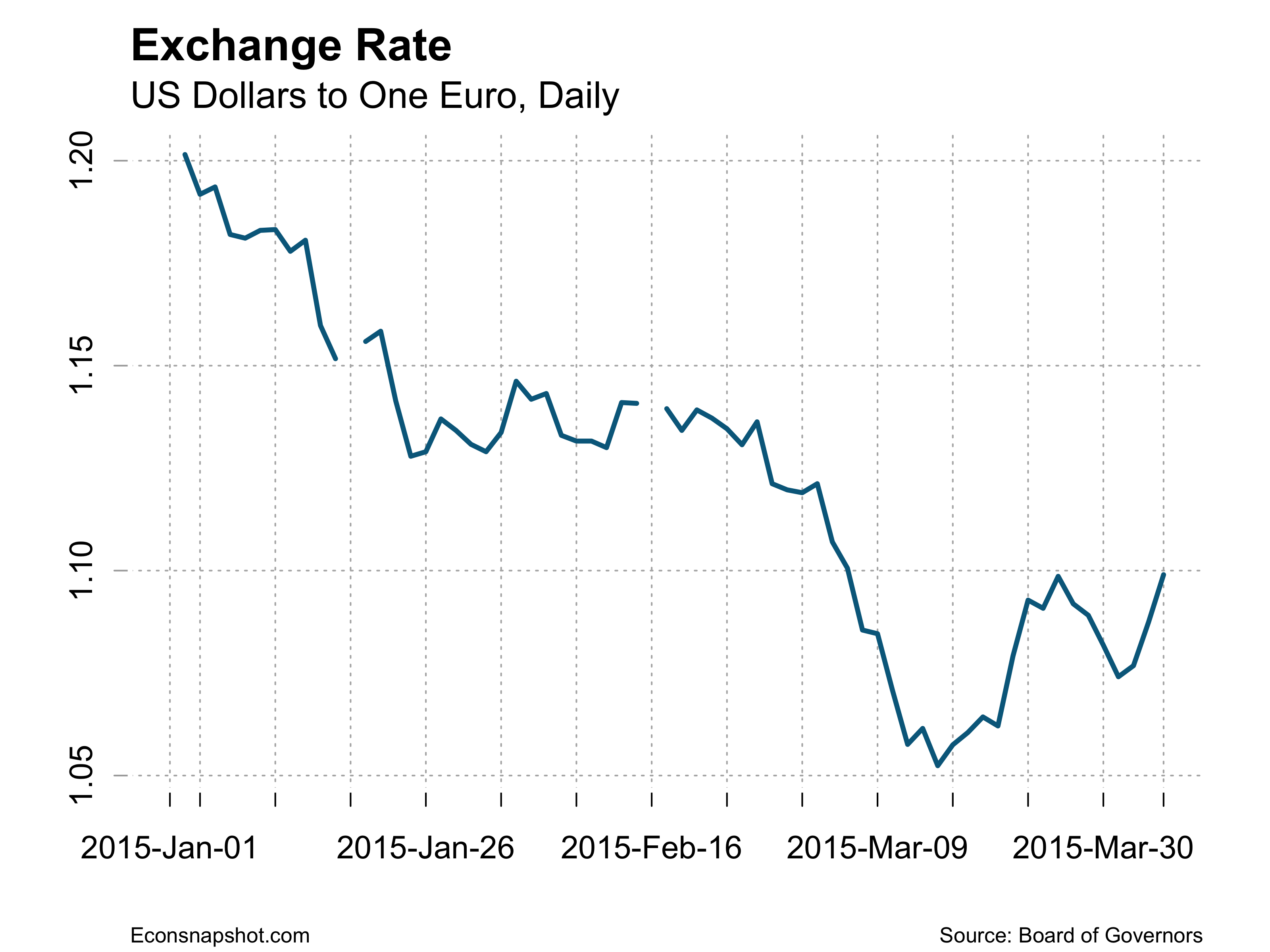

The recent news from Europe has been much more optimistic about a budding recovery for most Europe and the Eurozone. The dramatic decline in the value of the Euro against the dollar and the beginning of the ECB’s program of quantitative easing has sparked optimism about the prospects for recovery. With complete data for 2014 now in we can begin to see some uptick in European growth. Whether this will prove to be a robust recovery remains to be seen - for now it qualifies only as little green shoots and the problems of Greece will weigh heavily in the months to come.

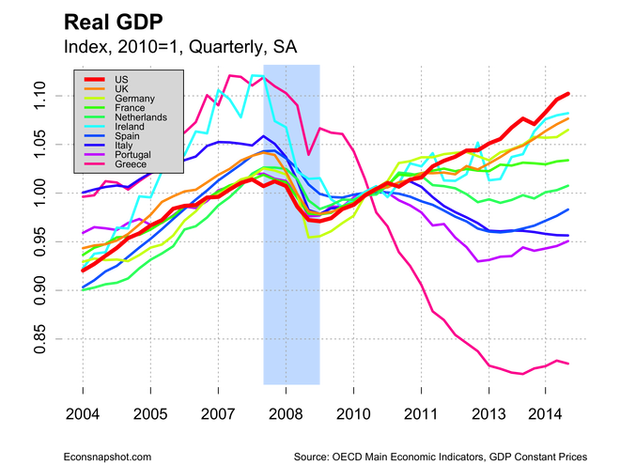

Europe is a story of diverging economic fortunes and those diverging fortunes are leading to political unrest in many countries. The growing influence of more extreme parties is one of the results as countries resist the economic orthodoxy that seems to be imposed by Germany and the wealthier countries. The following chart is based on OECD Data - we have been forced to abandon Eurostat as a data source as they seem incapable of updating the national accounts data for their member countries in a timely way. This shows that, since 2010, U.S. GDP has increased by 10% - slower than we might have wished. Ireland, the U.K. and Germany have increased by 7-8% while others have been much more stagnant…and then there is Greece. Even those economies that have been stagnant, aside from Greece and Italy, show some signs of improvement.

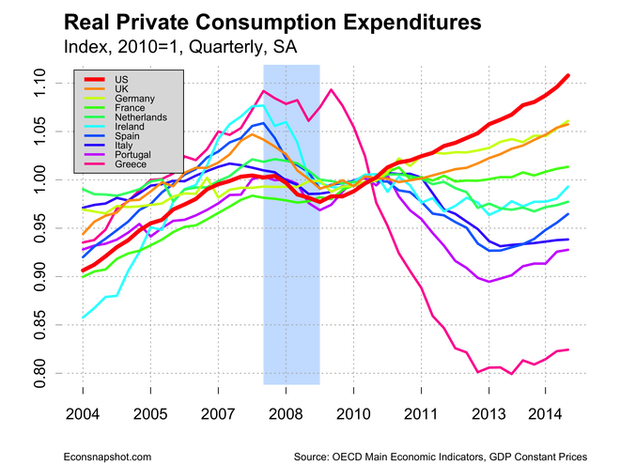

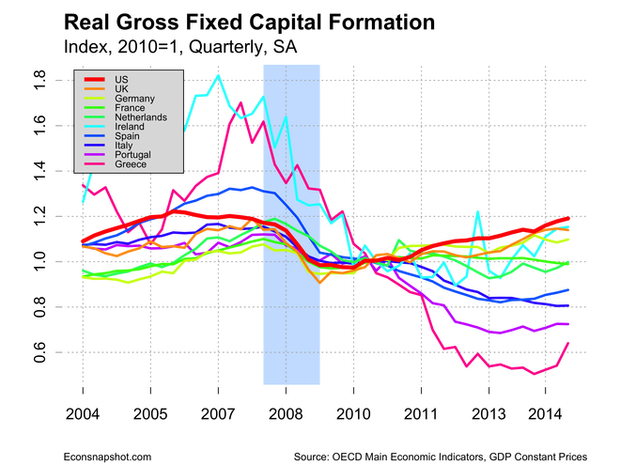

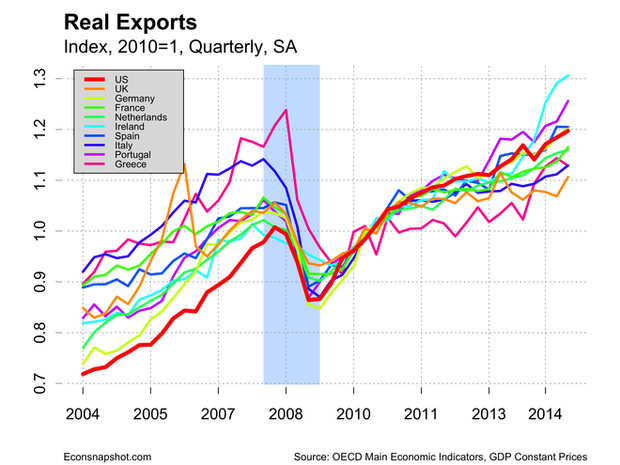

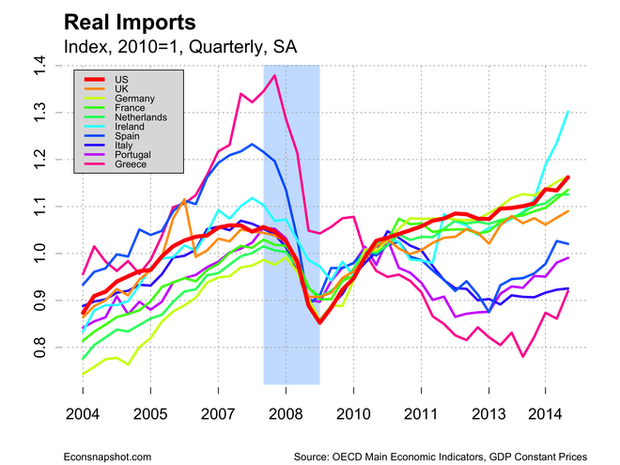

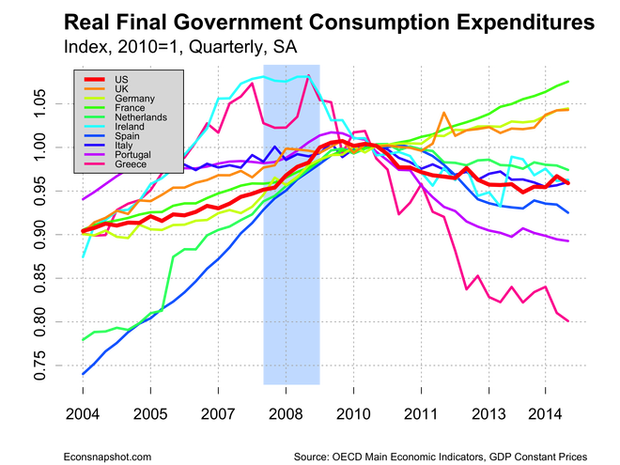

Consumption show much the same picture but most countries have seen an uptick in late 2014. Investment is more of a concern as it has been slow to recover. Exports are improving across Europe aided by a sharp fall in the value of the Euro beginning in early 2014. The improvements in the economies will be further aided by the continued fall in the the first quarter of 2015.

How robust can this recovery be? Clearly the ECB is determined to stimulate the economy and address the issue of deflation with its program of quantitative easing and the attendant impact on the value of the Euro. The problems of Greece, however, cast a long shadow over the whole Eurozone. Absent a solution that addresses the structural flaws in the Eurozone economy, and given the diverging economic fortunes, any solution to the Greek crisis will be short lived. Were Greece to exit, attention would shift to the other vulnerable economies, most notably Italy and Portugal. It will take more time to assess how effect the ECB can be on its own as the driving force of Eurozone recovery.